Musk's backing of Trump sees Tesla's value rise above the trillion dollar mark

Tesla's shares surged by 8.2% last Friday, pushing its market capitalisation above $1tn (€0.93tn) for the first time in more than two years. Tesla benefited from Trump's victory in the US election, driven by expectations that his administration will grant the electric car maker favourable treatment.

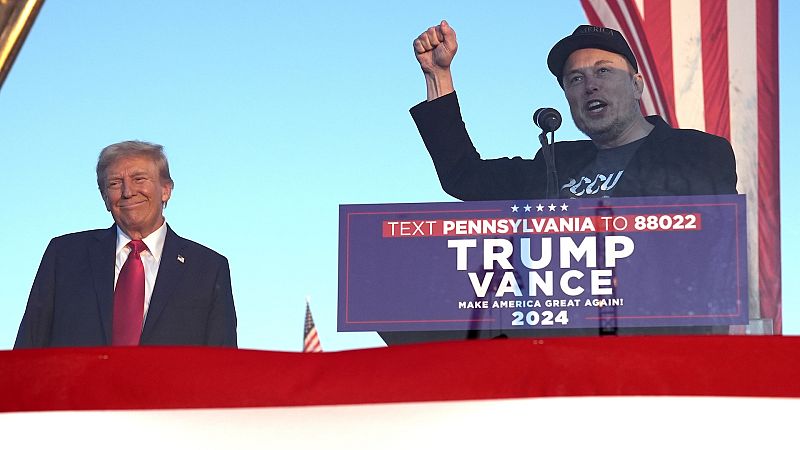

Tesla CEO Elon Musk was a prominent supporter of Trump’s campaign, contributing at least $130m (€121tn). Before the election, Tesla was the worst performer among the US tech giants, the so-called "Magnificent Seven".

After a 29% post-election surge, the US-based firm regained popularity, with its shares now up 30% year-to-date, reaching a market valuation of $1.03tn (€0.96tn) as of Friday's close.

Tesla May Gain Approval for Full Self-Driving (FSD) Technology

Robotaxi and FSD technology have recently become focal points for Tesla, with CEO Elon Musk indicating that the company could launch autonomous ride-hailing services in Texas and California, with potential for expansion to other states by 2025, pending regulatory approval.

The Trump administration could improve Tesla's chances of securing approval for its autonomous technology for public use, potentially accelerating growth in this business.

In overseas markets, Tesla faces fierce competition from Chinese electric car manufacturer BYD and Japanese automaker Toyota. Trump's proposed tariffs could also benefit Tesla in key markets, thereby strengthening its competitiveness.

However, Trump may remove all subsidies for electric vehicles in the US, which under the Biden administration provided Tesla with $739m (€685m) in regulatory credits in the third quarter.

This heightens Musk's urgency to overcome regulatory hurdles for its long-anticipated Robotaxi services. Its Cybercab could potentially begin mass production by 2026 or sooner, as Musk has indicated.

A Robust Third-Quarter Earnings Result

It is worth noting that Tesla's share surge was not solely due to Trump's election victory. The world's largest electric car maker has demonstrated a significant turnaround in its third-quarter performance.

Tesla's core automotive revenue grew by 2% year-on-year, returning to growth after declines in the previous two quarters. Total revenue rose by 8% year-on-year, marking the strongest growth in a year.

Elon Musk anticipates that automotive deliveries will increase by 20%-30% in 2025, signalling a rebound in demand for electric vehicles. Tesla delivered 462,890 electric vehicles in the third quarter, a 6.4% year-on-year increase and a return to growth after two consecutive quarterly declines. This was also the highest third-quarter figure and the third-largest quarterly total in the company’s history.

A notable highlight is Tesla's Energy division, which continued its rapid growth, with revenue rising by 52% year-on-year in the third quarter. The Energy business achieved a record gross margin of 30.5% in the third quarter. Additionally, Tesla's Cybertruck achieved profitability for the first time. Production of an affordable car is also on track to begin in the first half of 2025, with volume anticipated to grow by 50%.

A Valuation Hype

However, the 29% weekly jump in Tesla's shares may reflect an overvaluation, as fundamental changes have yet to materialise.

Until policies are formally enacted in its favour, the stock may be overvalued. Tesla's price-to-earnings ratio rose to 88 from 68 in just one week, exceeding that of AI chipmaker Nvidia at 69. For Tesla to sustain this valuation level, earnings growth would need to accelerate significantly going forward.

"That's not an uptrend - it's an explosion! Whatever the prospects for Tesla in the medium to long term this sort of erratic price behaviour is rarely sustainable", Michael McCarthy, the market strategist and CCO at Moomoo Australia.

Yesterday