Here's why Chinese carmakers are beating the Europeans in Kazakhstan

Ten years ago, streets in Kazakhstan were full of BMWs, Volkswagens, Mercedes and many other European car brands that have long been enjoying customer loyalty not only in Kazakhstan, but in the post-Soviet space in general.

Today, one cannot miss the fact that Chinese-made BYD, Changan, Chery, Geely appear on the roads much more often. Euronews talked to several industry specialists to understand the reasons behind the shift.

A Chinese conquest?

Many economic and geopolitical factors have supported the expansion of Chinese automotive companies in Kazakhstan.

Over the years, Chinese manufacturers improved their production methods. They invest billions of dollars in design, technology, and safety, and are now supplying vehicles of much higher quality than 20 years ago.

The speed at which they are upgrading is also undeniable, said Artur Miskaryan, CEO of Kazakhstan’s Agency for Monitoring and Analysis of the Automotive Market.

He highlighted that China is rushing to fill a gap left by European brands.

The expert explained that companies like BMW, Renault, Peugeot, Volkswagen had their production facilities in neighbouring Russia, which supplied the vast Russian market as well as Central Asia.

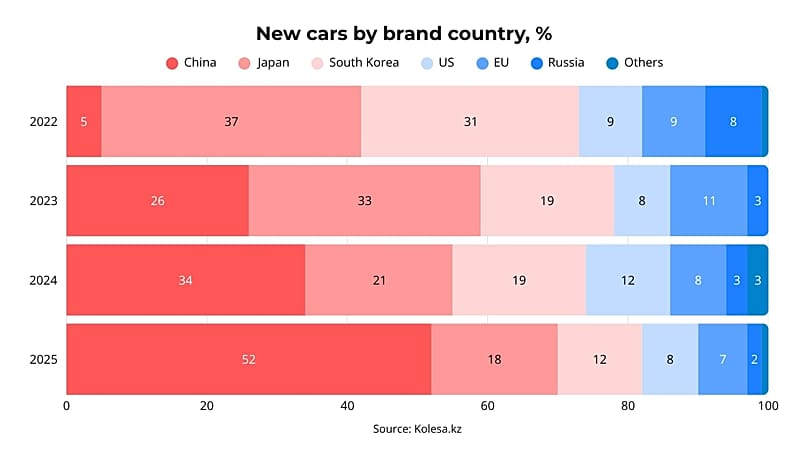

Since the onset of the Russia-Ukraine war, the companies closed their production and therefore lost easier and cheaper supply chains to the eastern side of the frontline.

“European automakers simply lost their positions. And these positions were, quite logically, taken over by the Chinese brands,” Miskaryan emphasised.

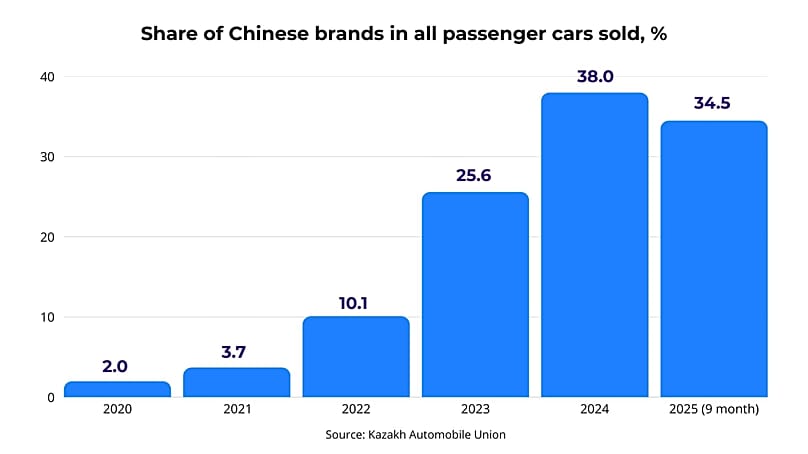

This can be seen by looking at the market share of Chinese carmakers in Kazakhstan. According to the Kazakhstan Automobile Union (KAU), while in 2020 their market presence was only around 2%, it had risen to 38% in 2024.

During the first nine months of 2025, the share of the market dominated by Chinese carmakers came to 34.5%. The number of represented brands grew from only JAC in 2020 to 21 brands in 2025.

“This growth is explained by a combination of affordable prices, a wide range of models and technologically advanced configurations,” said Kazakhstan Automobile Union President Anar Makasheva.

China also benefits from sharing a border with three out of five Central Asian states, making delivery times much shorter.

European cars, on the other hand, are dominating the premium segment with brands like BMW, Porsche, Mercedes-Benz, Audi, Land Rover and others.

“European brands occupy leading positions within the premium segment, with a combined share of 83.8% of all car sales in this segment,” said Makasheva.

They also enjoy popularity in the commercial segment with Volvo, Scania, and Mercedes-Benz.

The question of finance

Chinese car manufacturers also realised that more than half of the buyers either take out a loan or pay in instalments, which is why they are working with local banks to establish their own loan structures.

“Chinese brands, at least in our market, have a lot of agreements with banks where they have quite attractive rates that are much lower than their competitors,” said Yerbol Shombinov, head of the new cars division at Kolesa.kz, a platform for selling and buying cars.

Down payment is often as low as 5% to 10%, sometimes even reaching 0%. This helps Chinese brands drastically increase their sales.

Not only loan structures, but also general pricing of the car plays a key role.

“Even within the same class, European models are often more expensive. Chinese models are often more budget-friendly, while offering a wider configuration,” said Shombinov.

In case of Kazakhstan, the prices are highly affected by exchange rate volatility. Over the last year, the euro exchange rate grew from 534 tenge in January to 647 tenge in October. Inflation grew from 8.9% to 12.6%.

This is why local buyers are increasingly looking towards locally manufactured cars.

“The price of such vehicles is determined in tenge, dealers take on some of the logistical risks and introduce financing programs for buyers, while warranty service and spare parts supply are organised within the country,” highlighted Anar Makasheva.

Kazakhstan is also set to introduce a leasing mechanism with opportunity to buy out the car once the contract ends. No details have been announced yet, but companies that will agree to participate will most likely benefit.

Localisation of production

Chinese brands tried to enter Kazakhstan's market several times since 2007, but never successfully gained a foothold until JAC opened its own production plant in 2014.

“It was this brand's experience that signalled to Chinese manufacturers that, in order to consolidate their market position and plan their work here for the long term, they needed to establish production here,” said Artur Miskaryan.

Localisation makes delivery times much shorter and pricing more predictable, as well as eliminating the risk of illegal imports. So far, 64% of cars registered in 2025 are made locally.

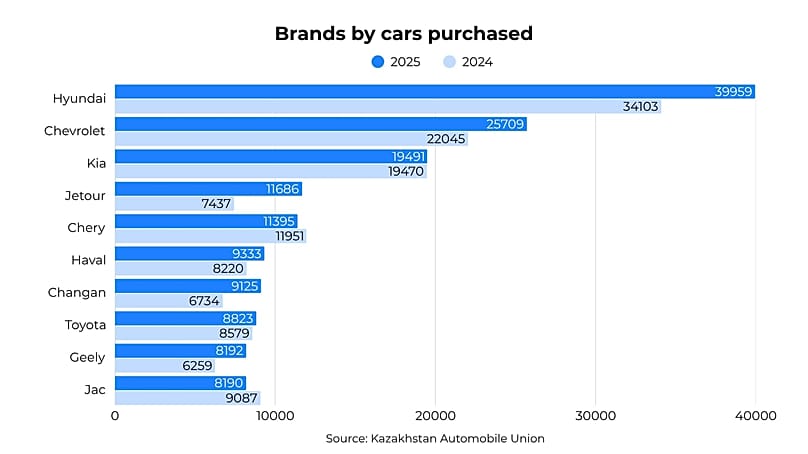

Currently, there’s an Astana Motors plant that produces Hyundai, and an Allur plant that produces Kia, Chevrolet, JAC, Jetour, Hongqi, and Skoda cars. In October, Kia also launched an independent plant nearby.

Hyundai, Kia, and Chevrolet have been the top three most popular brands in Kazakhstan for several years now, with Hyundai Tucson and Chevrolet Cobalt competing for leadership every month.

Astana Motors example

In September, Astana Motors launched a new CKD plant that will be producing up to 120,000 units of Chery, Changan and Great Wall Motor (Haval and Tank) cars.

All three are in the top 5 Chinese automobile producers and have their own R&D centres that receive billions of funding. The latter was important for the motor company when considering brands for localisation.

“A significant factor was the willingness to engage in joint development and creation of models taking into account the specifics of the Kazakh market, climatic and geographical conditions,” Astana Motors press service said.

The flexible approach of Chinese producers to local markets (such as integrating the Kazakh language into multimedia and voice control systems), as well as the willingness to produce components locally and share technologies were all taken into account.

Localisation creates long-term value for the country’s economy, creates jobs, develops engineering competencies, and stimulates the growth of related industries.

It also reduces dependence on imports, logistics costs, and currency fluctuations.

New cars vs. old cars

According to Kazakhstan’s Bureau of National Statistics, 41% of registered passenger cars today are more than 20 years old.

The resale value of Chinese cars remains a question today. Unlike European brands, which do very well on the secondary market, the fate of Chinese cars is yet to be determined.

“The secondary market is still more wary of Chinese cars than of brands that have been well-known for a long time,” noted Miskaryan.

When brands entered the market in 2022, there were many concerns that Chinese models would lose half of their value, if not more, within a year.

“We see from our analytics that, in reality, Chinese brands and specific models do not lose value as significantly as expected,” said Yerbol Shombinov.

Experts believe that, provided there are no market shocks, Chinese cars will continue to hold a firm position in the Kazakh market, while those with localised production will benefit the most.

Today