Where are Russia's immobilised assets? Nobody, except Belgium, wants to say

When Belgian Prime Minister Bart De Wever put his foot down at last month's EU summit and blocked a bold plan to issue a €140 billion reparations loan to Ukraine using the immobilised assets of the Russian Central Bank, he complained of being singled out.

After all, the audacious project is solely based on the funds held at Euroclear, a central securities depository based in Brussels, despite G7 allies repeatedly saying they have about €300 billion in paralysed sovereign assets spread across their jurisdictions.

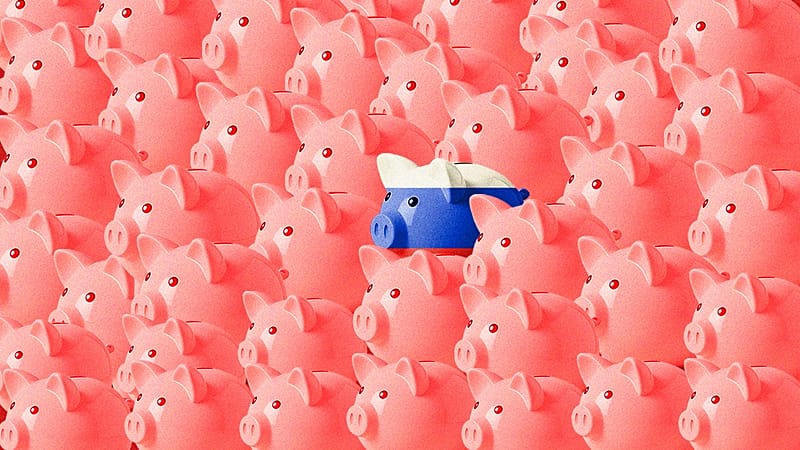

"The fattest chicken is in Belgium, but there are other chickens around," De Wever said. "Nobody ever talks about this."

Indeed, nobody, or hardly anybody, does.

Following De Wever's remarks at the inconclusive summit, Euronews reached out to the Western countries that, through media reports and independent analyses, have been identified as holding a share of the Russian Central Bank's assets.

These are: France, Luxembourg, Germany, Switzerland, the United Kingdom, the United States, Canada, Japan and Australia, all of which are aligned with the international effort to cripple the Kremlin's war machine and bring the invasion of Ukraine to an end.

Ironically, the most precise replies came from the two countries most traditionally linked with financial obscurity: Luxembourg and Switzerland.

According to a recent study by the European Parliament's research service, Luxembourg keeps some €10 billion to €20 billion in Russian sovereign assets.

But in a joint statement, the Grand Duchy's finance and foreign affairs ministers provided a drastically different number. "The amount of assets of the Central Bank of Russia currently immobilised in Luxembourg is below €10,000," they said.

Switzerland, for its part, confirmed it holds 7.45 billion Swiss francs, about €8 billion, in Russian sovereign assets. The funds are kept in commercial banks.

Switzerland is neither an EU nor a G7 member state, so it is not compelled to follow the initiative to issue a reparations loan. Still, it is keeping a close eye on the process.

"The Federal Council will determine its position taking into account Swiss law, including international law, Switzerland's foreign policy objectives as well as the preservation of financial stability in order to avoid unintended consequences for financial markets and future central bank operations in the international financial system," it said.

The other countries contacted by Euronews provided statements of varying lengths but avoided clarifying how many Russian sovereign assets they hold.

Germany, which is estimated to hold a limited share in the immobilised funds, said it could not "disclose the volume or location of assets of the Russian Central Bank" in the country due to data protection requirements and EU sanctions law.

Japan was equally non-committal. The country is believed to hold somewhere between €25 billion and €30 billion in Russian sovereign assets, a number never formally confirmed by Tokyo. (De Wever has claimed Japan keeps €50 billion alone.)

"The Government of Japan does not disclose the information regarding the details of Russia's sovereign assets located in Japan, including their amount and locations. Therefore, we refrain from making comments about that," the statement said.

France declined to comment on the value of the assets guarded on its soil, even if its former finance minister, Bruno de Maire, had previously spoken about having immobilised €22.8 billion from the Russian Central Bank.

The US Department of the Treasury did not reply to Euronews.

In September 2023, Axios reported that a global task force known as Russian Elites, Proxies and Oligarchs (REPO) had found an estimated $5.06 billion(€4.41 billion) in Russian sovereign assets spread across the American banking system.

Wall of silence

The lack of transparency from the West stands in stark contrast to the clarity in Belgium.

Euroclear regularly publishes reports on the Russian sovereign assets, their composition by currency and updates on the windfall profits they generate. Policy-makers, investors, journalists and analysts all have access to the data.

Admittedly, Euroclear, as a central securities depository, is bound by stricter standards of transparency and oversight compared to private banks, where the principles of secrecy and privacy are considered sacrosanct to protect clients.

As of today, G7 allies are unable to provide a detailed breakdown of the Russian sovereign assets they control, a glaring failure in the context of the reparations loan.

The European Commission, which drafted the ambitious proposal for the €140 billion loan, has repeatedly dodged questions on whether it would look beyond Euroclear.

Dr Szymon Zaręba, a senior researcher at the Polish Institute of International Affairs (PISM), attempted to pinpoint the precise location and value of the Russian Central Bank assets. His effort was met with the same obstacles that Euronews encountered.

"During our informal discussions with representatives of some G7 and EU member states, we did not receive any information regarding the reasons why data on the exact size of assets is not publicly available," Zaręba said.

The researcher challenged the view that divulging clear-cut stats about the assets might expose Western companies that still operate in Russia to retaliatory confiscation by the Kremlin, a prospect also evoked by De Wever in his recent remarks.

"After all, Russia knows exactly where its funds were deposited before the war broke out, when its assets were frozen, and whose private property to target," he added.

Another recurring hurdle in the search for the assets is the (rare) distinction between sovereign assets, namely the reserves of the Russian Central Bank, and private assets of sanctioned Russian individuals, such as oligarchs and business leaders.

The UK is a prime example.

On the one hand, the country has thrown its weight behind the reparations loan.

"Now is the time for international action to use Russia’s frozen sovereign assets to support Ukraine," Foreign Secretary Yvette Cooper wrote in The Times. "Because, frankly, it is Russia that should pay for the damage they are doing to Ukraine."

But on the other hand, it has sown confusion about how many assets it holds.

As of May 2025, the UK's Office of Financial Sanctions Implementation (OFSI) has registered £28.7 billion (about €32.6 billion) in assets frozen as a result of the multiple sanctions imposed on Russia since February 2022. But in reality, the headline figure of £28.7 billion, often quoted in the press, excludes sovereign assets altogether.

The British government declined to provide a separate number.

The Royal Canadian Mounted Police (RCMP) says Canada has "effectively" frozen CAD$185 million (€114 million) in Russian assets and blocked CAD$473 million (€291 million) in transactions as a result. However, Euronews received no indication of how much, if any, belonged to the Russian Central Bank, making it impossible to distinguish.

Australia, which has a smaller amount, also declined to provide a breakdown.

"There are no exact figures. That's worth emphasising in all of this. The individual states may have some idea – or you would hope they would have a rough idea of exactly what's within their jurisdictions – but there's very little public oversight over that. And that's why the debate is happening in such broad terms," said Francis Bond, a senior associate at the Macfarlanes law firm specialised in international sanctions.

"We've never seen anything like this proposed. And it is a response to something that is seen as a completely extraordinary and unusual situation. And this is why the legal risks, the financial risks and the political risks are so high, because we don't really have a roadmap for determining how this may play out."