Russian marketplaces to benefit from new EAEU Customs Code

Kazakhstan is the last of the Eurasian Economic Union (EAEU) countries to ratify a new Customs Code that will oblige its citizens to declare all online purchases made outside of the union.

It will also change the customs duty mechanism, essentially making goods from China, the European Union, or the United States more expensive.

Within the EAEU territory, which includes Kazakhstan, Kyrgyzstan, Russia, Armenia, and Belarus, parcels will remain exempt from duties and declarations.

This essentially puts Russian marketplaces such as Wildberries and Ozon at an ample advantage, considering they are already widely represented across the EAEU.

Kazakhstan’s capital Astana alone has 159 Wildberries and 128 Ozon order pickup points.

At the moment, all online purchases costing less than €200 and weighing less than 31 kilograms are exempt from customs duty and declaration. If the shipment exceeds the price limit, the duty is 15% (including VAT) of the exceeding amount.

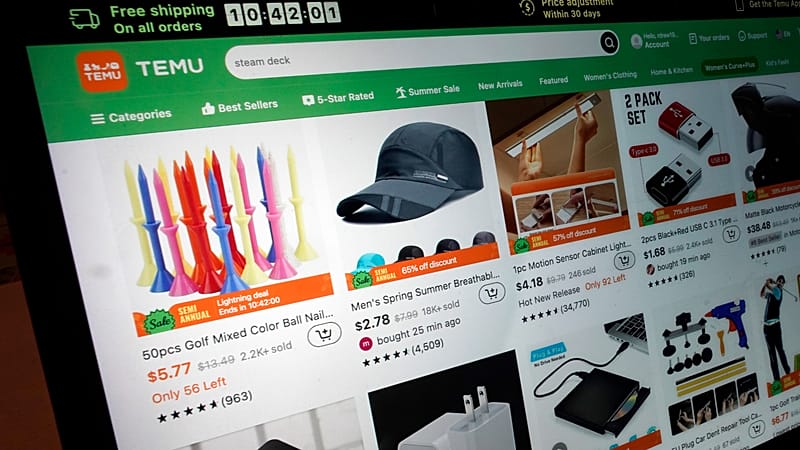

With the new Code, anything procured from marketplaces such as Amazon, eBay, Alibaba, Pindoudou, Temu and others will have to declared, even if it’s a pen or a pair of socks.

Although the price limit will remain at €200, the new duty will be 5% of the entire sum plus a value added tax (VAT). The VAT differs across countries, with Russia, Armenia and Belarus having 20%, and Kyrgyzstan and Kazakhstan having 12%.

“Five plus 12 equals 17%, so the cost will increase slightly from 15% by 2%,” said Kazakhstan’s vice minister for national economy Azamat Amrin.

Kazakhstan is also increasing its VAT to 16% starting on 1 January 2026, meaning the overall duty payment will soon rise to 21%.

Although e-commerce operators will pay the VAT and fill in the declaration forms, both will most likely be reflected in the final price for the customer.

Earlier, Amrin said that filling in a declaration by the e-commerce operator (DHL, FedEx) will cost €6-8, but considering that Chinese marketplaces offer prices as low as €1, for EAEU citizens this will be a significant increase in price.

It will also affect delivery times, as the goods will have to be placed in a storage facility until the declaration is filled.

Timeline

The regime, however, will not take effect right away. Besides the ratification of the code, all countries must bring their customs laws into alignment with the code, which will take time. The regime will start simultaneously, when all countries finish all procedures.

“For the new customs regulation to come into force, the Commission must adopt certain regulations regarding e-commerce goods,” stated the State Revenue Committee of the Kazakh Ministry of Finance.

“And EAEU member states must align their national customs legislation with the Protocol's provisions. Kazakhstan also needs to complete this procedure.”

It's therefore unclear when the changes will finally be implemented.

What does the Kazakh government say?

Kazakh officials say that the new system will allow them to generate reliable statistics on online purchases, but they claim that price changes will be minimal for most shipments.

“The majority of e-commerce orders do not exceed €200 and are therefore not subject to customs duties,” said the Kazakh Ministry of National Economy.

“Given that the duty-free import thresholds will remain the same, changes in the amount of payments, taxes and declaration procedures will have a minor impact on the final cost of goods.”

The authorities also say that declaration is going to be fully digital and fairly simple. In fact, Kazakhstan has been piloting the project since 2023, after the EAEU member countries signed the protocol on introducing these changes.

Combatting Chinese influence

Some commentators also suggest that the shipment changes could be the way to slow an influx of cheap, Chinese goods coming into Kazakhstan, making it more difficult for other businesses to compete.

By making the products more expensive through increased customs duties, the authorities hope to help local businesses. Still, the mechanism likely will benefit Russian firms the most, as they are already very well represented in all EAEU countries.

Today